Global stocks have had a muted start to the week, with stocks in Europe and the US both lower on Monday. The FTSE 100 is an outlier and is edging closer to last week’s record highs.

Large gains for Astra Zeneca and the LSE are helping to boost the main UK blue chip index. Astra Zeneca is gaining after the company said that its experimental hypertension drug met all requirements in a late-stage trial. These results are sending investors into a frenzy because it boosts the company’s competitive profile, and it could be a multi-billion-dollar sales opportunity. AZ believe that sales of the drug Baxdrostat could generate $5bn per year, and it also boosts the company’s M&A division, who acquired the drug after buying CinCor Pharma in 2023.

In the US, the stock market malaise may prove to be temporary, as companies linked to crypto surge on Monday, after Bitcoin reached a record high above $121,000 and is currently higher by $2000 on Monday. Coinbase, the listed crypto exchange, is higher by nearly 2% on Monday. The surge in crypto is linked to the House of Representatives in the US, which is preparing to consider key industry legislation this week and is adding more fuel to this rally. The House could vote on the Clarity Act, Anti CBDC Surveillance State Act and the Senate’s Genius stablecoin package. These acts could expand the use of bitcoin and usher in a new era for digital currencies and their usage in the broader economy.

When analysts are more pessimistic than the companies themselves

This is a key week for US equities as earnings season gets into full swing, with high profile bank earnings including JP Morgan and Goldman Sachs reporting Q2 results. Netflix is also the first of the large tech firms to report on Thursday evening.

As we lead up to earnings season, analysts have been getting bearish about the outlook due to fears of a weakening economy and tariffs, and earnings expectations have been cut by more than average, according to FactSet. All but one sector on the S&P 500 have seen their earnings estimates cut by analysts in recent weeks. The energy sector has come in for the biggest cuts, followed by consumer discretionary and materials. Communications has seen their earnings forecasts remain stable.

Interestingly, companies themselves are more optimistic than usual about Q2, earnings season. 110 S&P 500 companies have reported Q2 earnings guidance, and 59 have issued positive EPS guidance, which is above the 5-year average of 57. The positive outlook has been led by the tech sector, with industrials and healthcare in second and third place. Interestingly, the tech sector also has the largest number of companies issuing negative guidance for Q2. This could be a sign that there will be a big divergence within the tech sector, and some companies will perform better than others.

Earnings focus: US Banks and why BOA may be a weak spot

The banking sector is in focus on Tuesday and Wednesday when the bulk of the S&P 500’s top tier banks will report Q2 earnings. The financial sector does not usually issue guidance, so their reports will be parsed for details on profits and revenues. However, there were several decent tailwinds that could have boosted the sector, including market volatility, which may boost the trading revenues for the biggest US banks, and steady borrowing costs, which may have preserved net interest income.

While trading revenues could be a bright spot, all eyes will also be on loan loss provisions, which are hard to predict ahead of time. The loan loss provisions should give us a clearer idea on the outlook for the US economy, and an update on the health of the consumer.

JP Morgan is the bellwether as the US’s largest bank. It is expected to boost its net interest income target for this year, as it benefits from elevated interest rates in the US, and profit growth from loans could top 3% in Q2. This may be dwarfed by trading revenue, which some analysts expect to have surged by 8%.

Citi is expected to see an increase in revenue for its services unit, with Bank of America struggling due to high deposit rates, and overall revenue could fall 1% QoQ. Trading revenue could also be hard to beat for BOA, after it reported record high trading revenue at the start of the year.

The KBW banking index in the US has backed away from recent highs but remains close to the record high from 2022. It has had a stunning 44% rally since the low in April, and this earnings season may be crucial for where banking stocks go next. Although the banking sector has pulled back from 2025 highs, the uptrend remains intact, so a strong earnings season could help propel the KBW banking stock index back to the 2022 highs.

Chart 1: KBW banking index, 12-month chart

-638881103147303340.png)

Netflix preview

There are over 40 companies from the S&P 500 reporting earnings this week, including Pepsi Co, Johnson & Johnson and United Airlines. The other major earnings report that will likely garner media attention includes Netflix.

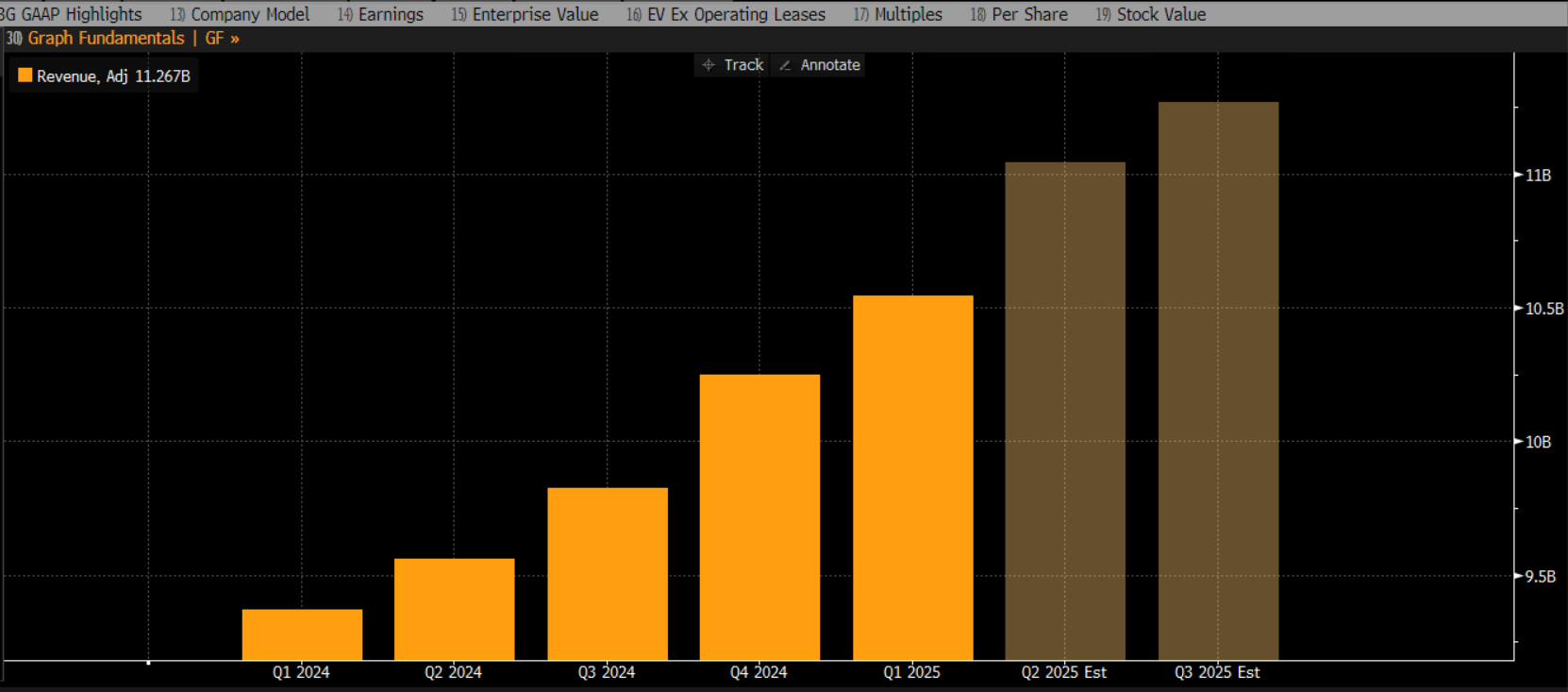

Since reaching a high on 30th June, the stock has backed up to the 50-day sma, where it is finding good support. Analysts are expecting the company to report $11.04bn in revenue, which is up from the $10.54bn reported in Q1. We will be watching to see if this came from advertising revenue, or from subscriber growth, although Netflix no longer provides subscriber numbers with its earnings reports. Net income is expected to rise to $3.17bn. At 46.6 times 12-month forward earnings, Netflix stocks are not cheap. However, over the last 8 quarters, the stock has risen by an average of 8.15% in the 24 hours after an earnings report. As you can see in the chart below, analysts are optimistic about revenues for Netflix for Q2 and Q3 this year. Thus, it will take a positive outlook from the company to justify this.

The fact that Netflix is the first of the major tech names to report earnings also means that this report will generate a lot of attention in the coming days.

Chart 2: Netflix quarterly revenues, including Q2 and Q3 expectations for 2025